I decided to have a life insurance this year (2015) I'm now in my late 20's, single, childless, been in the industry for 6 years. Somehow, I have my own emergency fund. Diversified my money through stocks, mutual funds and an investors of small business.

It was 1st week of January 2015 when an officemate talk to me regarding life insurance of PRU LIFE UK, at first it was hesitant and a bit awkward, because the topic is all about me in the future would encounter "illnesses", "accident" and the worst is "death" (knock on woods 3x) it's so taboo topic. She presented life insurance with investment. Since I am very interested in investments then I gave it a shot.

To make the story short, the "projection" of investment wowed me PLUS that I am also insured when I get the policy. It will force me to save for my retirement, for my future kids and for my family.

Before I decided to invest, I had my research, there is a lot of positive clients in the forum and bloggers recommending the products of Pru Life UK, their investment really increase year by year (this is a long term investment). Then I assess myself if how much I can save per month, you know this is another responsibility. I go for it, thinking of savings with added benefits, just in case anything will happen, my family and I is secured.

Now, I am PruLink Assurance Account Plus (PAA) holder and hope I do the right decision.

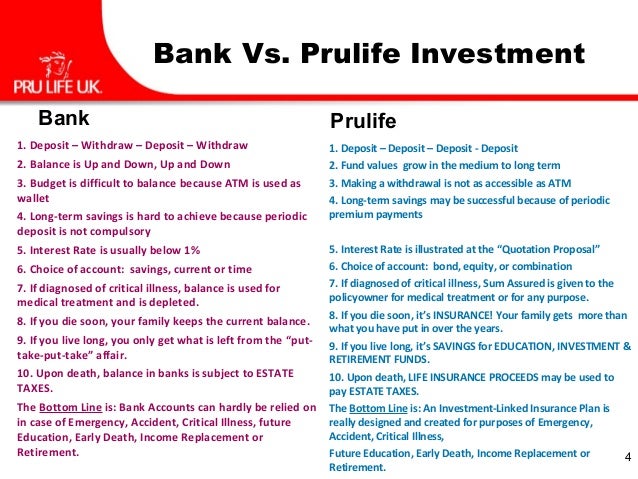

This is just an illustration when you save 5k per month

NB. I'm not an agent of PRU. Pru Life UK is different from PH Prudential Life. I talked to different agents, was compared PRU Life package to the other well known life insurance company, I can say that I am happy with Pru life, they have better packages.

Related link:

2 comments:

Very informative, ate. Thanks for sharing. :)

Hi Yella, Thanks for visiting :)

Post a Comment